Equally important is the continuation of price growth.

According to the forecasts of the analytical center "Rusagrotrans", Russia plans to export around 4.5 million tons of wheat in August 2024. This number exceeds the result of July 2024 (3.6 million tons), but is lower than the same period in 2023 (5.4 million tons). This information was provided by the Interfax agency, citing "Rusagrotrans."

According to "Rusagrotrans," the average annual export figure from Russia in August over the past five years stands at 4.9 million tons. In its previous forecast, "Rusagrotrans" expected exports to be in the range of 4 to 4.5 million tons of wheat in August 2024.

According to analysts, Russian wheat on the global market lost $2 in price, reaching $220 per ton (FOB). Meanwhile, the price of French wheat increased by $4, reaching $244 per ton, German wheat by $3, reaching $246 per ton, American wheat by $9, rising to $220 per ton. The rise in prices was due to news of reduced wheat yields and quality in France due to rains and insufficient plantings. This season could be the worst in 40 years.

The second factor influencing prices is the tenders of Egypt and Algeria, especially Egypt, which plans to purchase 3.8 million tons of wheat over 7 months starting from October 2024. Discussing prices for 4th grade wheat with 12.5% protein in deep-water ports of the Russian Federation, analysts emphasized an increase of 300 rubles, reaching 16100-16200 rubles per ton without VAT. On the river, the price increased by 500 rubles and amounts to 15500 rubles per ton without VAT. A year ago, these prices were 16700 rubles and 14600 rubles respectively.

In the domestic market of Russia, the price of wheat increased in the European part of the country, but decreased in Siberia. In the South, the price rose by 550 rubles and now stands at 14300-14800 rubles per ton without VAT, in the center - by 500 rubles, reaching 13000 rubles, in the Volga region - by 850 rubles, ranging from 12900 to 13600 rubles per ton. In Siberia, the price decreased to 11800-12700 rubles per ton without VAT due to the start of harvesting, expectations of high yields, and import restrictions from Kazakhstan.

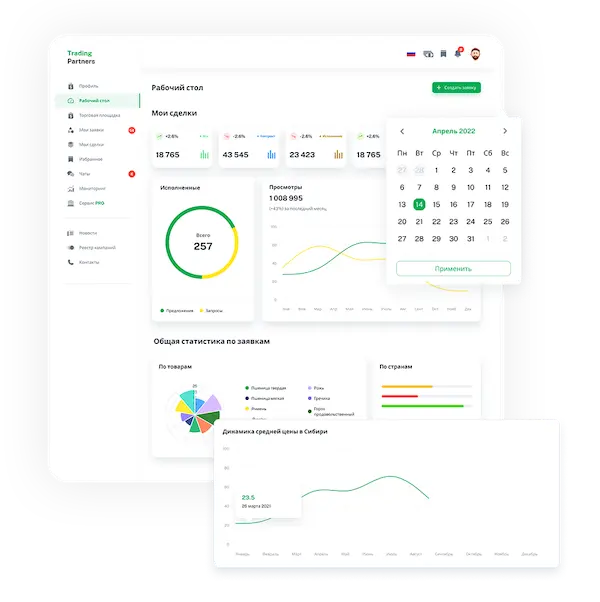

Trading platform

Trading platform

Monitoring

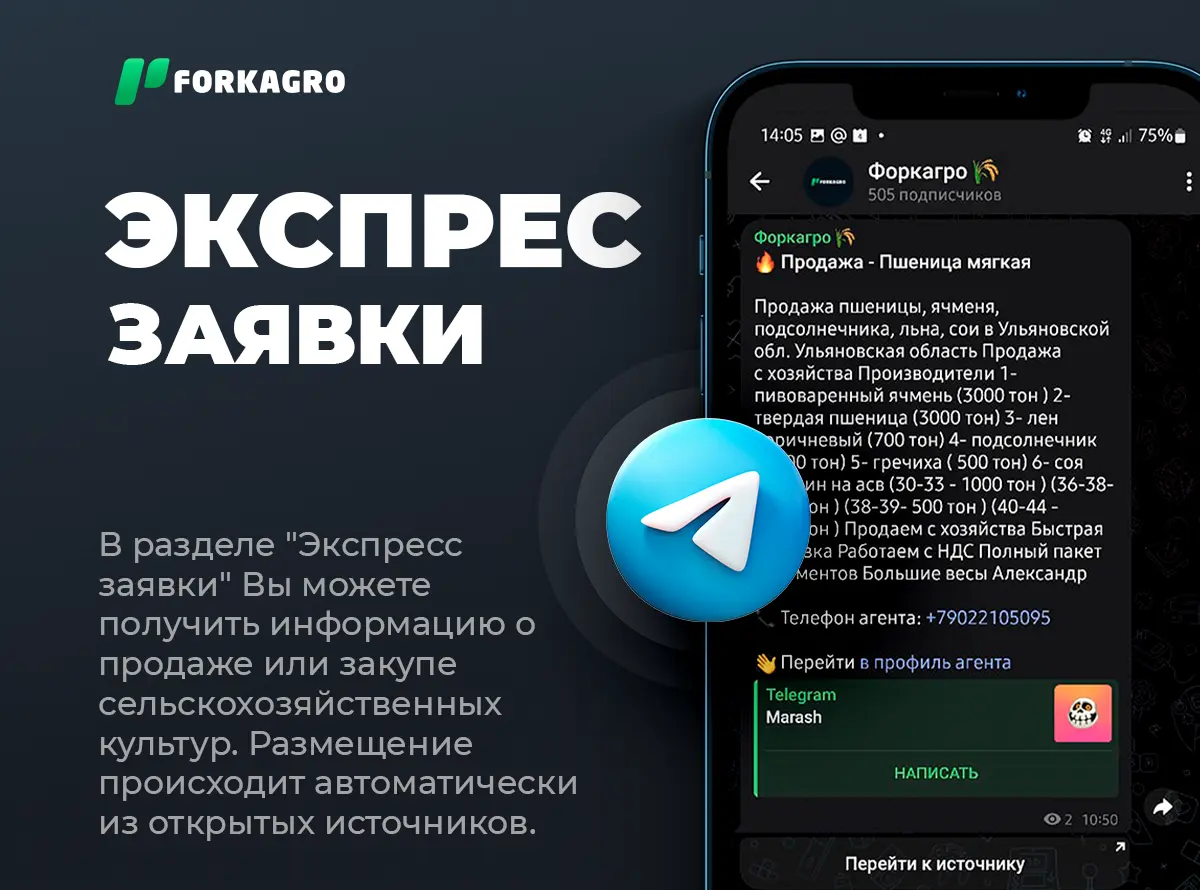

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory