The merger between Bunge and Viterra is nearing completion, and it will create an agricultural giant worth over $30 billion, including debt.

Detailed terms of the deal, which were not previously disclosed, will be carefully reviewed by antitrust regulators.

Bunge's market capitalization is estimated at around $14 billion, with net debt, excluding cash, of about $2.7 billion. A significant portion of the deal will be done through shares, but cash and debt financing from banks will also be used.

The combined company will be led by Bunge's management team under the leadership of Greg Heckman, sources added.

Private shareholders of Viterra, including Glencore, the Canada Pension Plan Investment Board (CPPIB), and the British Columbia Investment Management Corporation, may finalize the deal on June 10-11 if negotiations are successful.

However, there is a possibility that the deal may not go through, cautioned anonymous sources, as it is confidential. And, according to the same sources, the final deal value may change depending on Bunge's stock movement at the time of agreement.

Trading in key agricultural products such as wheat, corn, and soybeans is already represented by Bunge and three other major market participants - Archer-Daniels-Midland Co, Cargill Inc, and Louis Dreyfus Co. Together they are known as the "ABCD" and generate significant profits. Last year, Bunge was the largest exporter of corn and soybeans from Brazil. Viterra was the third-largest corn exporter and the seventh-largest soybean supplier.

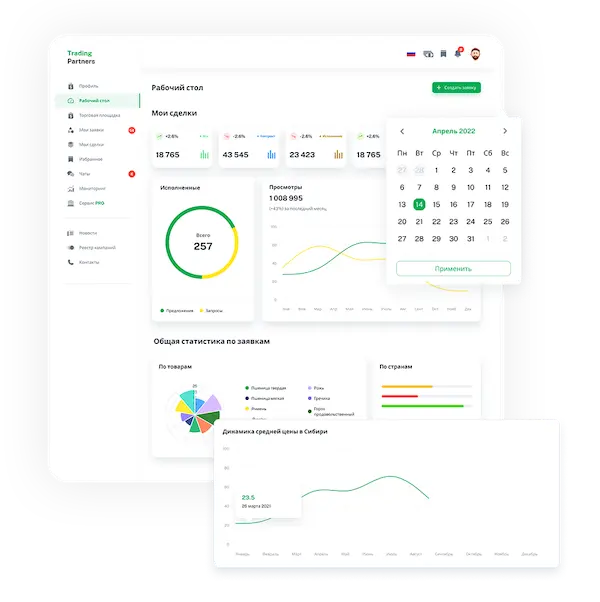

Trading platform

Trading platform

Monitoring

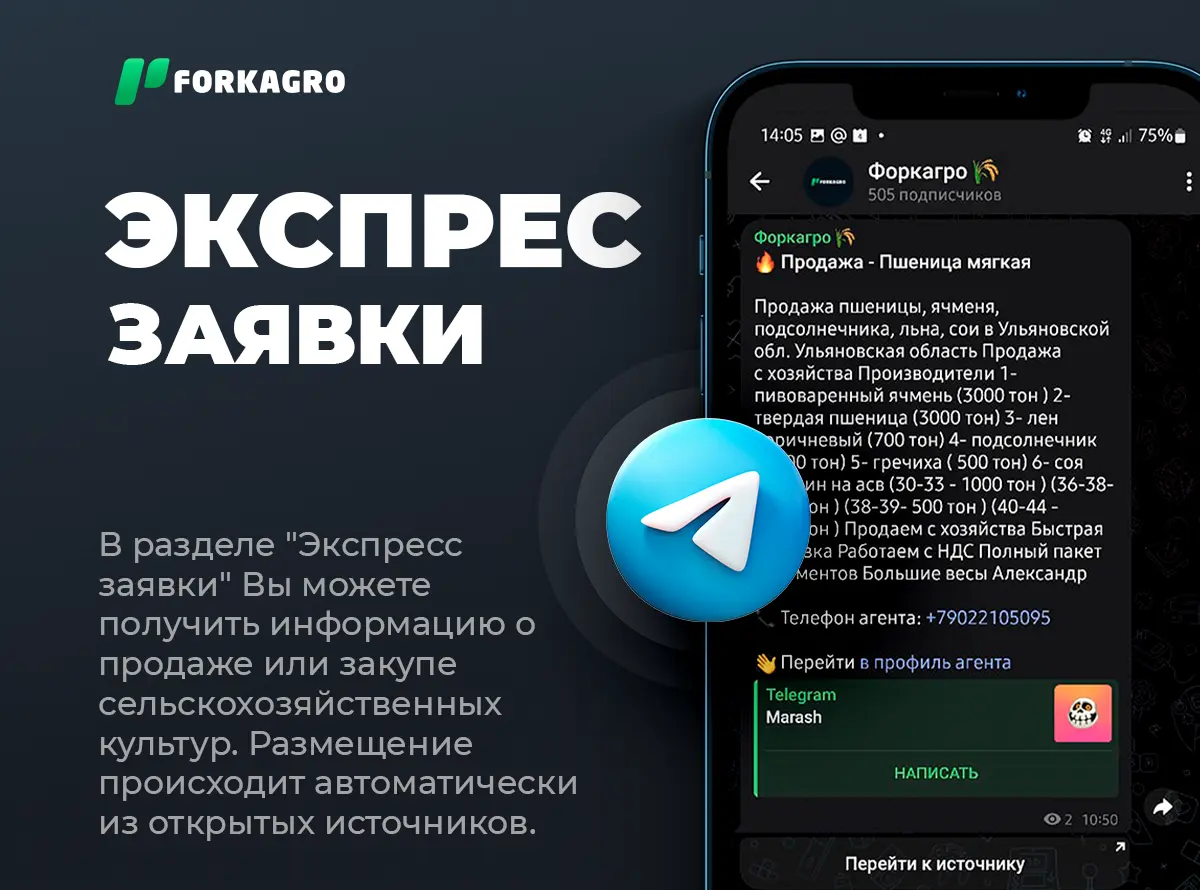

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory