From 28.02.25 to 07.03.25, there was a decrease in world prices for wheat. Prices for various types of wheat and other grain products changed as follows:

- Soft red winter wheat on the Chicago Mercantile Exchange (CBOT, ZW) fell to 533.75 cents/bushel (-0.61%);

- Hard red winter wheat on the Kansas City Board of Trade (KCBT, KE) decreased to 551.25 cents/bushel (-1.25%);

- Hard red spring wheat on the Minneapolis Grain Exchange (MGE, MWE) decreased to 578.00 cents/bushel (-0.73%);

The corn contract on the Chicago Board of Trade (CBOT, ZC) rose to 455.25 cents/bushel (+0.39%). The price of rice in Chicago (CBOT, ZR) decreased to $13.24 per hundredweight (-0.30%).

In the Russian market, the following prices are recorded:

- Wheat - $242.20 per tonne (+0.21%);

- Barley - $204.00 per tonne (+0.00%);

- Corn - $220.90 per tonne (+0.00%);

The CPT Novorossiysk wheat index fell to 18,155 rubles per tonne (-0.66%).

Prices for 4th class wheat with a protein content of 12.5% at the port elevators of the Black and Azov Seas are as follows:

- Azov - 16,700 (0) rubles per tonne

- Novorossiysk - 19,050 (-150) rubles per tonne

- Rostov-on-Don - 16,700 (0) rubles per tonne

- Taman - 17,800 (-150) rubles per tonne

GRAIN MARKET NEWS

• Spring sowing has begun in Russia. It is expected that the total sown area will be higher than last year and will be around 84 million hectares, with about 55.8 million hectares dedicated to spring crops. 87% of winter crops are in good and satisfactory condition.

• The weather in the European part of Russia was warm and had little snow in winter, which improved the condition of winter crops but led to a lack of precipitation. This maintains the threat of spring drought, and the wheat harvest forecast is lowered.

• The Ministry of Agriculture has stopped accepting applications from agricultural producers for preferential grain transportation by rail. The annual limits for preferential transport were exhausted within just 2 months of 2025. The remaining grain transportation as of February 26 was 15.4 tons against a planned 1.92 million tons.

• Sales of Russian agricultural machinery on the domestic market decreased by 31.5% in January. In 2024, the decline was 17.6%. The largest drop in sales is noticeable in the segment of self-propelled forage harvesters, combine harvesters, and tractors. Due to the new utilization scale that came into effect on January 1, imports of agricultural machinery decreased by 60%. Manufacturers are demanding increased government support, in particular expanding funding for program 1432. A co-owner of "Rostselmash" called 2024 the worst year for sales in the last 10 years.

• The Ministry of Agriculture of the Russian Federation does not rule out the introduction of additional non-tariff measures if the grain harvest in 2025 turns out to be lower than projected due to weather conditions. The official grain harvest forecast for this year has not yet been published. Currently, an export quota for wheat has been introduced, the volume of which has been reduced compared to last year to 10.6 million tons. The Ministry of Agriculture has also informed the president about the high risks of rising prices for food-grade wheat flour due to a decrease in its production.

• Wheat stocks in agricultural organizations decreased by 31.5% compared to last year and amounted to 13.7 million tons as of February 1, 2025. The reduction in stocks was due to active export shipments in the first half of the season, according to the analytical center "SovEcon".

• The government is developing measures to stimulate rice production by opening highly profitable export markets. Currently, there is a ban on rice exports until June 30, 2025. Russia banned rice exports on July 1, 2022, after the accident at the Fedorovskoye hydro plant and has repeatedly extended this ban. The Ministry of Agriculture intends to resume exports after increasing production to 2 million tons per year.

• Customs duties on all grain crops will increase from March 12, 2025.

BELARUS

The first hectares of early spring cereals have already been sown in the Brest region, in the Zhabinovsky and Ivanovsky districts. The weather for field work is favorable.

KAZAKHSTAN

• The Ministry of Agriculture of Kazakhstan introduced subsidies for wheat exports from January 1 to September 1, 2025. The main goal of the subsidies is to remove excess grain from the market and free up elevator capacities. The government plans to allocate 40 billion tenge to subsidize the export of 2 million tons of wheat.

• This year, 5.8 million tons of new crop grains have been exported, which is 53% more than last year. The main export destinations were Uzbekistan, Tajikistan, and Afghanistan.

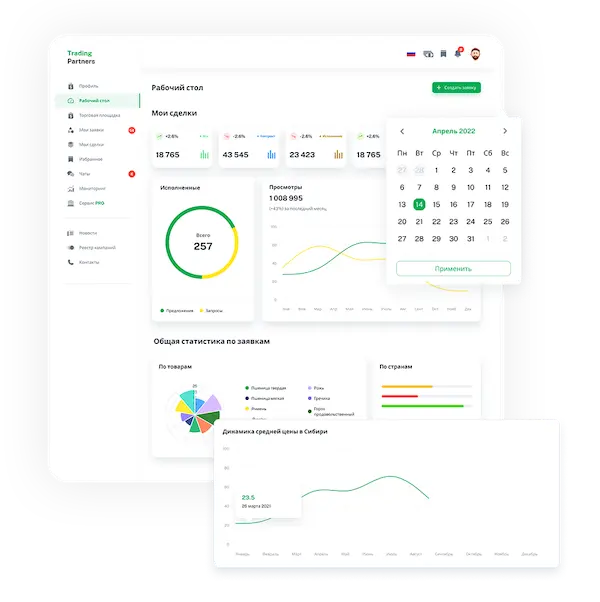

Trading platform

Trading platform

Monitoring

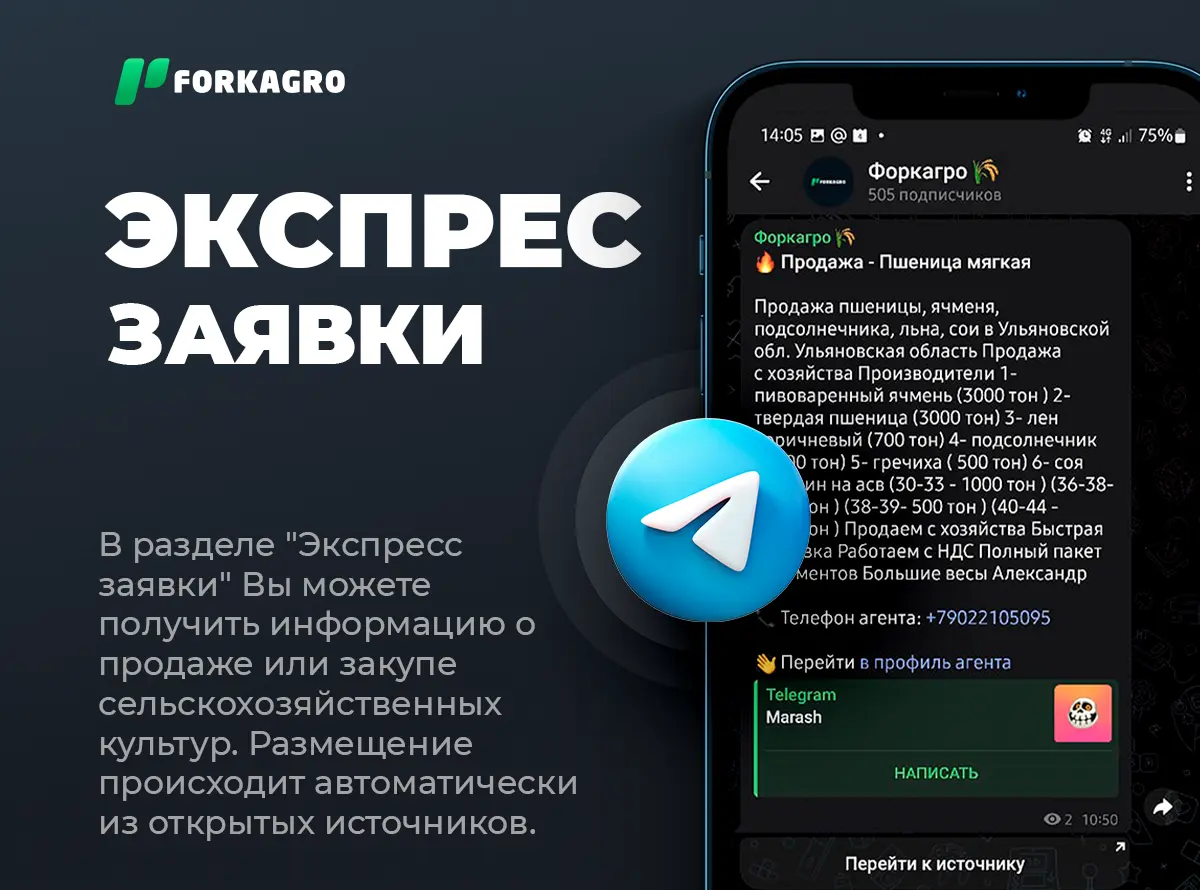

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory