According to the results of the first quarter of this year, pork production decreased by 1.5% compared to the same period last year. The General Director of the National Union of Pig Breeders (NUPB), Yuriy Kovalev, announced that an increase in indicators is expected relative to 2024 within the range of 0.5-1.5%. He expressed his industry forecasts at the XX industry business conference "Agroinvestor: PRO Livestock and Compound Feeds."

Over the past 15 years, pork production has been growing at a rate of 5% to 10% annually. This growth was distributed among three main directions. The first direction is import substitution in the domestic market, the second is growth in domestic consumption, and the third is an export-oriented strategy. In 2018, the last preferential loans for commodity production were obtained, which allowed the construction of enterprises to start and increase production rates until 2024. Planned growth rate reductions started in November 2023. The previous year was the final year when pork production growth rates reached about 5%. In the first half of 2024, growth rates were even higher.

According to NUPB forecasts, over the next five years, the growth of pork production will be 1-2% per year. This is enough to achieve the government's goals by 2030 and minimize risks associated with sharp demand spikes. Although growth rates will decrease, the base is already very high, so it is important to actively develop exports to avoid market saturation. In 2024, pork exports increased by a third, reaching 320 thousand tons, half of which were deliveries to China. Currently, exports account for about 6-7% of total production, and NUPB's strategic goal is to achieve an export share of about 10% of production.

Kovalev emphasized that the main goal of NUPB is to maintain the industry's profitability sufficient for expanded reproduction. He noted that profitability is formed based on wholesale prices and production costs. Wholesale prices for live pigs in 2024 increased by 3.5%, with inflation at 9.5% and food inflation at 11%. However, prices for processed pork decreased by 1%. If production rates had not decreased, this could have led to a price collapse. In the retail segment, prices for different pork cuts increased by 4-6%, which is below the inflation level. Pork consumption continues to grow, having increased by 34% over the past 10 years. The reason for this growth lies in the steady increase in production, while prices rose slower than the inflation rate.

Over the past five years, grain prices, especially barley and wheat for fodder, have increased by 39% and 30%, respectively, and prices for meal have increased by 14%. Along with other factors, this led to a 20-25% increase in production costs for pig farms. As a result, it is expected that companies' profitability will be 20-25%, at best. Kovalev emphasized that this is a new reality that the industry needs to deal with. He underscored the importance of ensuring production efficiency, noting that there is room for improvement, such as the annual meat production from one sow. The industry's average figure over the past five years was 3 tons, and some companies have reached 4 tons and more, which is an example to strive for improvement.

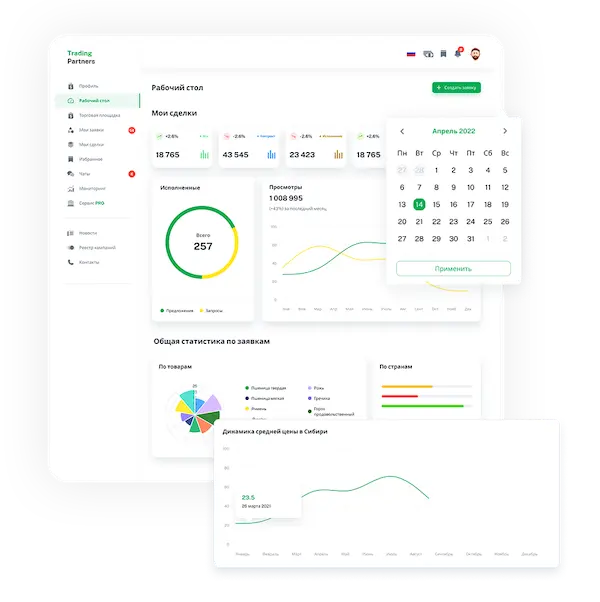

Trading platform

Trading platform

Monitoring

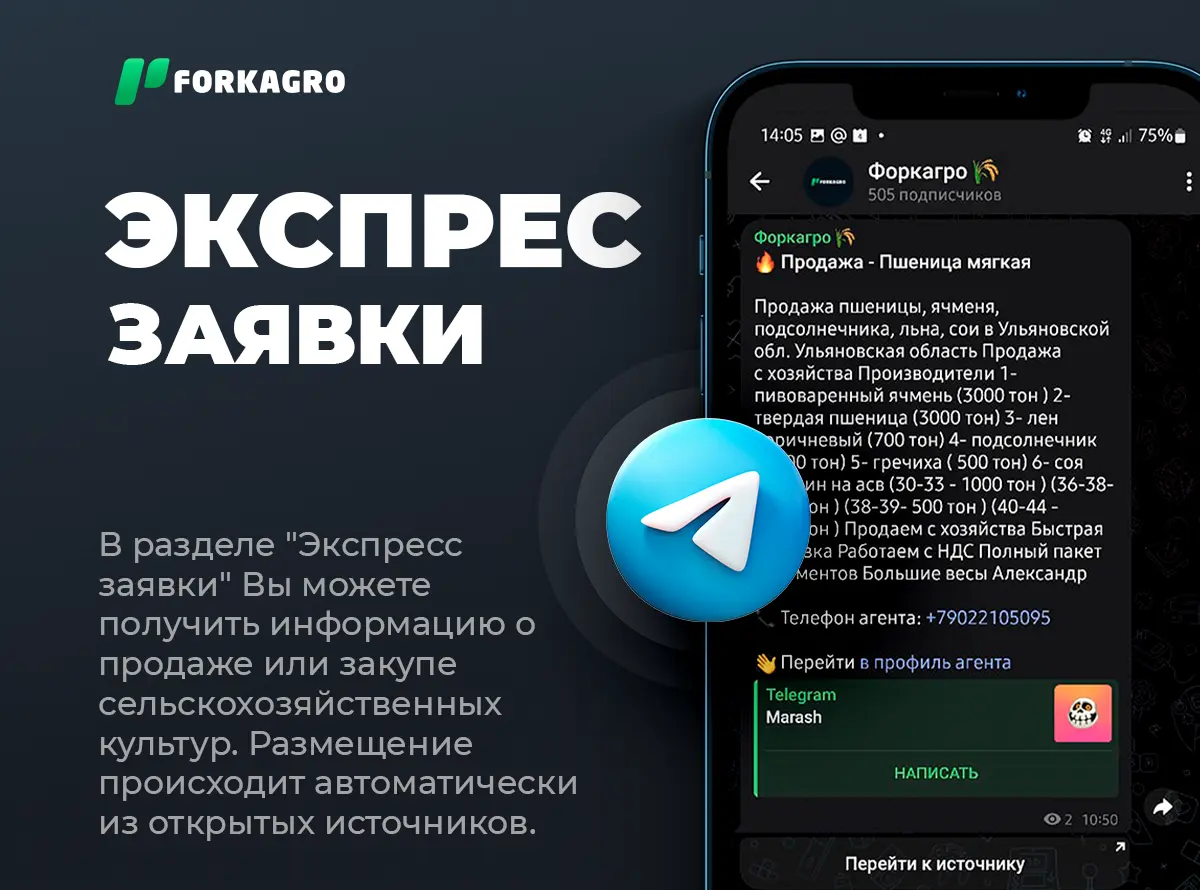

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory