On Wednesday, futures for Malaysian palm oil increased, following other vegetable oils on the Dalian Commodity Exchange, recovering some of the losses incurred in the previous session. However, the growth was limited due to the strengthening of the Malaysian ringgit.

“The rise in palm oil futures is determined by the growth on the Dalian Exchange, but the strengthening of the ringgit hinders full growth,” noted a trader from Kuala Lumpur.

The price of the basic contract for palm oil with delivery in September on the Malaysian Derivatives Exchange rose by 46 ringgit, which is 0.95%, reaching 3922 ringgit (833.58 US dollars) per metric ton at the closing. During overnight trading, there was a further increase of 1.06%.

The most active contract for soybean oil in Dalian added 1.1%, while the palm oil contract grew by 1.47%. The Chicago Commodity Exchange was closed due to a holiday on June 11.

Prices of palm oil are subject to changes in prices of other related oils as they compete for market share in the global vegetable oils market.

Amid weak exports and overnight price declines in Dalian, palm oil continued to decline.

The Malaysian ringgit, which is the currency of the contract trading, strengthened by 0.15% against the US dollar on Wednesday. A stronger ringgit makes palm oil less attractive to holders of foreign currency.

Data on the import of palm oil into the European Union for the 2023/24 year, obtained from official sources, showed that the volume of imports amounted to 3.22 million tons as of June 16, compared to 3.97 million tons imported in the previous year.

Technical analyst from Reuters, Van Tao, stated that palm oil may continue to rise in the range of 3965 to 4011 ringgit after failing to overcome the support level at 3889 ringgit.

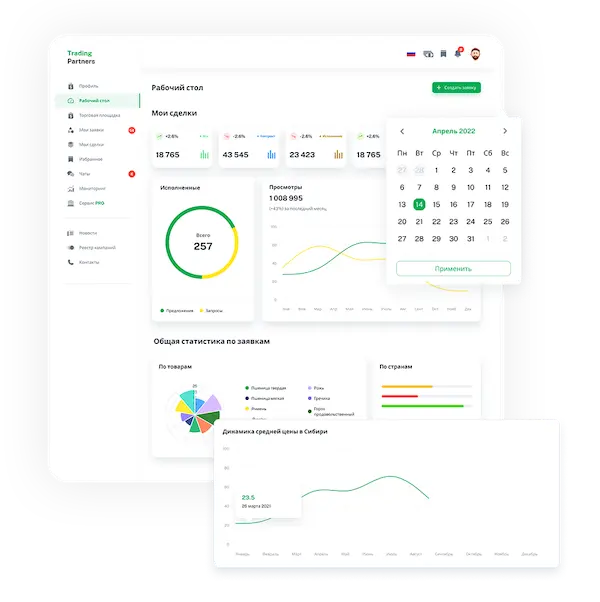

Trading platform

Trading platform

Monitoring

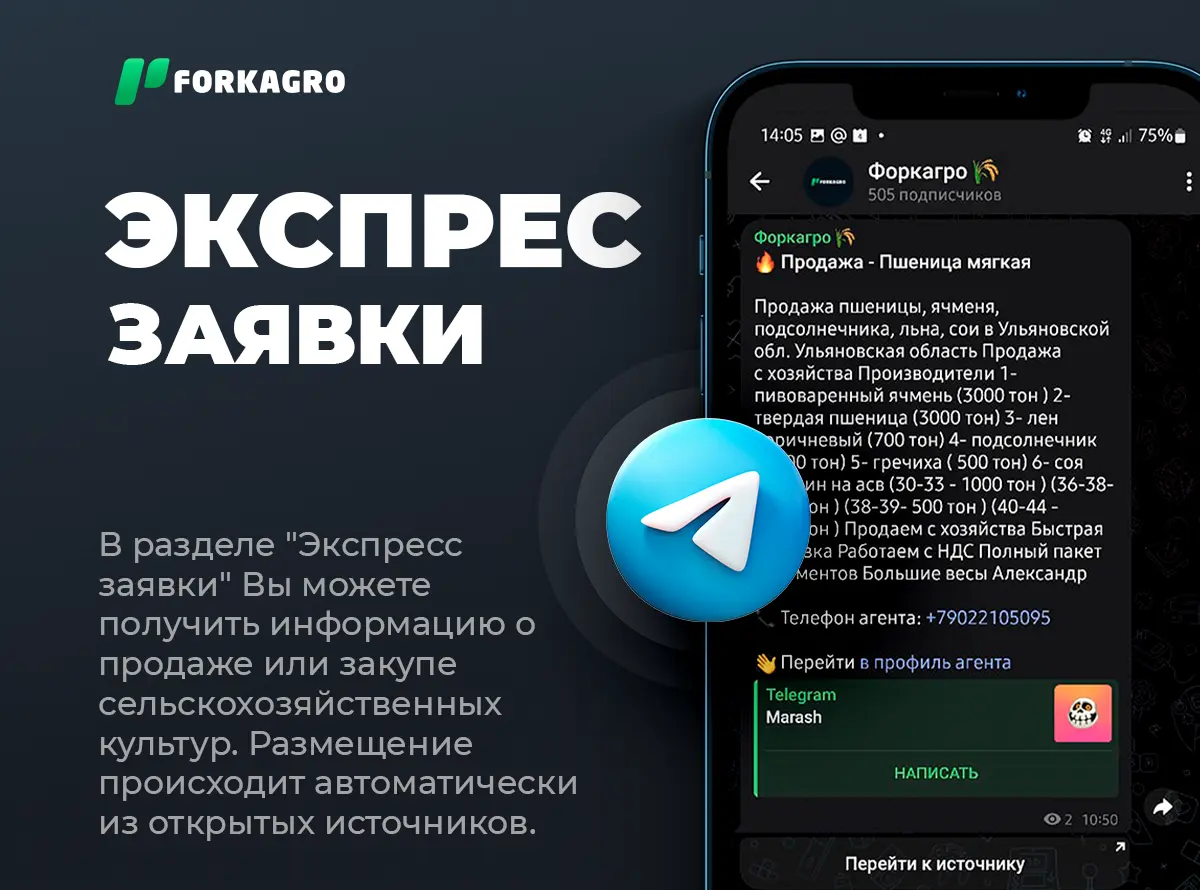

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory