During last week, from 22.03.24 to 29.03.24, global wheat prices displayed a mixed trend. The price of soft red winter wheat on the Chicago Board of Trade (CBOT, ZW) increased to 560.25 cents/bushel (+0.99%). Meanwhile, the price of hard red winter wheat on the Kansas City Board of Trade (KCBT, KE) decreased to 585.25 cents/bushel (-0.89%). Also, the price of hard red spring wheat on the Minneapolis Grain Exchange (MGE, MWE) decreased to 645.00 cents/bushel (-2.42%).

At the same time, the corn contract on the Chicago Board of Trade (CBOT, ZC) rose to 442.00 cents/bushel (+0.63%). However, the price of rice in Chicago (CBOT, ZR) decreased to $16.36/cwt (-5.65%).

Regarding indicative Russian prices (FOB Black Sea), the price of wheat decreased to $234.90/ton (-0.38%). At the same time, the price of barley increased to $188.50/ton (+3.86%), and the price of corn rose to $172.60/ton (+0.64%).

The latest Russian wheat index, CPT Novorossiysk, rose to 13270 rubles/ton (+2.21%).

As for domestic purchase prices for 4th class wheat with 12.5% protein in Russia, they vary as follows:

- Azov - 11600 (0) rubles/ton;

- Novorossiysk - 14000 (0) rubles/ton;

- Rostov-on-Don - 11600 (0) rubles/ton;

- Taganrog - 11200 (0) rubles/ton;

- Taman - 14000 (0) rubles/ton.

Rosselkhoznadzor has submitted a proposal to the Ministry of Agriculture for the redistribution of grain export quotas due to violations by some exporting companies. The company TD "RIF" has been suspended from grain shipments for export. Rosselkhoznadzor reported that since the beginning of 2024, discrepancies with the requirements of importing countries were found in 44 grain batches totaling over 1 million tons at TD "RIF", sparking rumors of possible pressure on the company.

The Governor of the Rostov region instructed the regional Ministry of Agriculture to investigate the circumstances described in the letter from the company TD "RIF". The company owner's letter reported unexpected pressure from the grain trader "Demetra-Holding". The downtime of "RIF" is estimated at $1 million per day. According to the President of FCS, A. Zlochevsky, the competitor's unfair game, aimed at market restructuring, slows down exports and worsens pricing for farmers.

The Ministry of Agriculture has already completed the distribution of the first part of additional export quotas for grain, totaling 2.4 million tons (10% of the total tariff quota volume). Additional quotas are allocated to organizations that already have primary quotas for grain exports.

The National Commodity Exchange (NTB), a part of the Moscow Exchange Group, has resumed grain purchases for the state intervention fund. Grain purchases for the state fund were suspended on March 7. From December 11, 2023, to March 29, 2024, the state fund purchased 881.6 thousand tons of grain for 12569.7 million rubles.

The area under hard wheat in Russia will almost double this year. In 2023, the area sown with hard wheat amounted to about 500 thousand hectares. The main regions producing hard wheat are Altai Krai, Orenburg, Chelyabinsk, Omsk, Saratov, Samara, and Volgograd regions. In December 2023, the Russian government imposed a ban on the export of hard wheat until May 31, 2024.

94.4% of winter grain sowings are in normal and good condition in Russia, allowing for a successful outcome with favorable weather conditions, as reported by the Russian Ministry of Agriculture. Fertilization of winter grains is carried out in 23 regions, while 13 regions are already sowing spring grains.

The General Prosecutor's Office has decided to transfer the shares of JSC "Makfa" – the largest pasta manufacturer in Russia, into state ownership. The lawsuit was filed in the Central District Court of Chelyabinsk. According to the supervisory authority, the company has a corrupt origin, as beneficiaries engaged in business while being in state bodies.

Customs duties on all grains will be increased starting from April 3, 2024.

BELARUS

Currently, early spring grains, excluding corn, buckwheat, and millet, are sown on 26.7% of the areas. As of March 29, 166.1 thousand hectares were sown.

KAZAKHSTAN

Sowing works are currently underway in the southern regions of the country, with 33.3 thousand hectares sown. Mass sowing will start in the second half of May. This year, it is planned to plant 23.8 million hectares of agricultural crops, which is 209.6 thousand hectares less than in 2023.

UKRAINE

All regions have started sowing spring crops. 476.7 thousand hectares of grains and legumes were sown. Of these, 68.3 thousand hectares are wheat and 291.5 thousand hectares are barley.

Additional news about the grain market of Russia and the CIS countries is available in our Telegram channel.

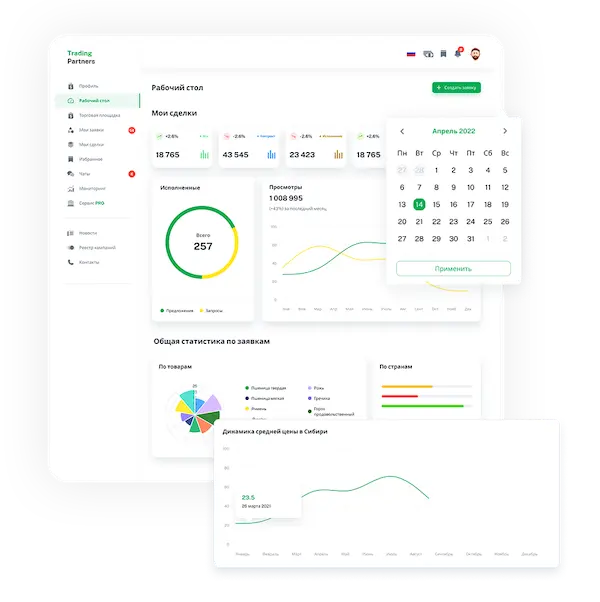

Trading platform

Trading platform

Monitoring

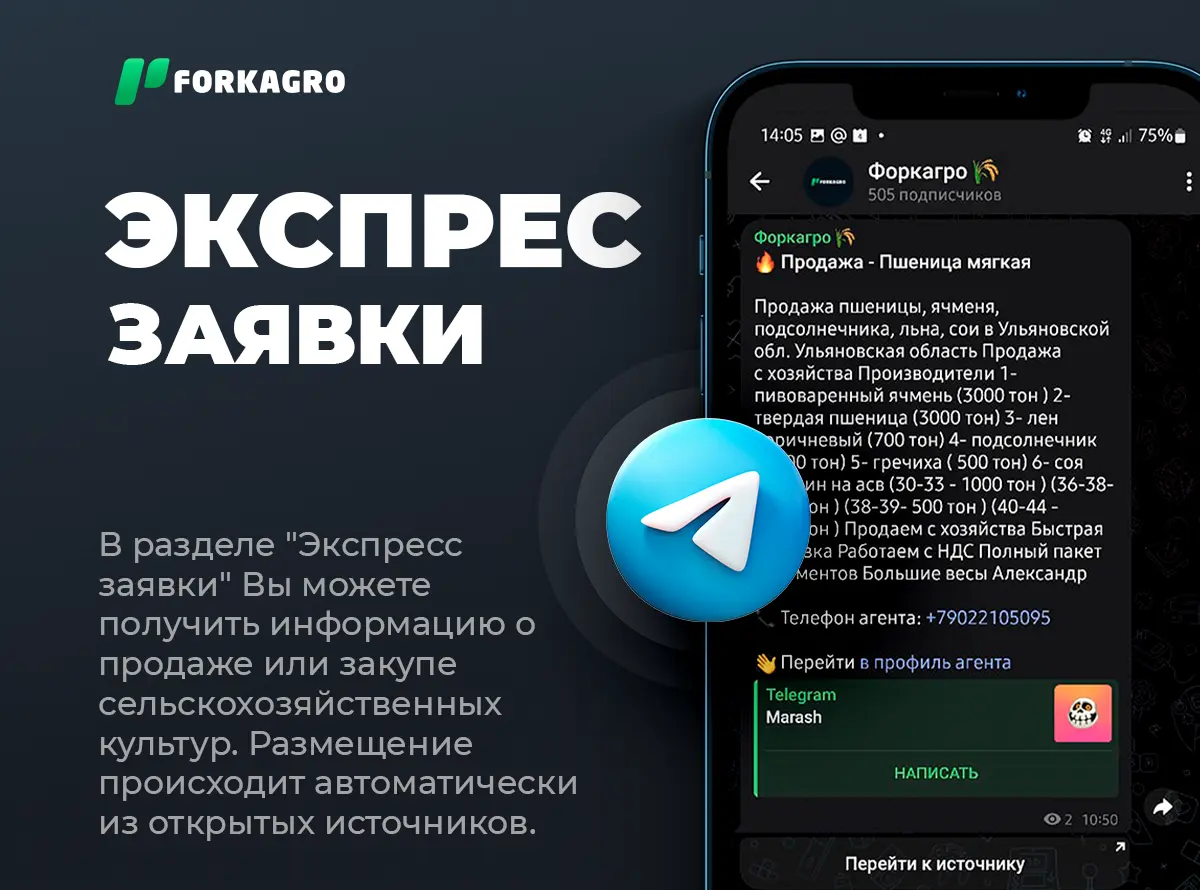

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory