Starting from January 1, 2024, and until the end of 2029, inclusive, setting a zero tax rate on the simplified tax system (STS) for all categories of taxpayers became the next step in supporting the agro-industrial complex.

In 2021-2022, at the initiative of Alexey Texler, the STS rate for regional farmers was halved, and last year, in 2023, the tax was completely canceled for enterprises and individual entrepreneurs where the number of employees was maintained and increased.

This year, it is proposed to extend this preferential condition to all STS payers, taking into account the current economic situation, which contributes to increasing the financial stability of farms and ensuring regional food security.

The task of developing a bill for the full repeal of the tax rate was voiced earlier by Governor Alexey Texler in his address to the Regional Legislative Assembly.

"In order to provide additional support to agricultural producers, I propose to reduce this tax to zero - essentially abolish it. I ask the Ministry of Agriculture of the region to promptly prepare the corresponding bill, and the deputies of the Legislative Assembly to support it," instructed Alexey Texler.

According to Article 31 of the Budget Code of the Russian Federation, compensation for the losses of local budgets is proposed to be carried out at the expense of regional budget funds through the provision of interbudgetary transfers.

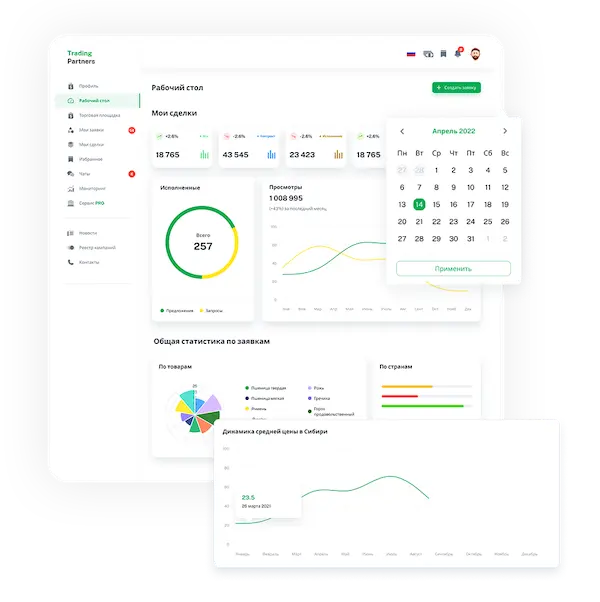

Trading platform

Trading platform

Monitoring

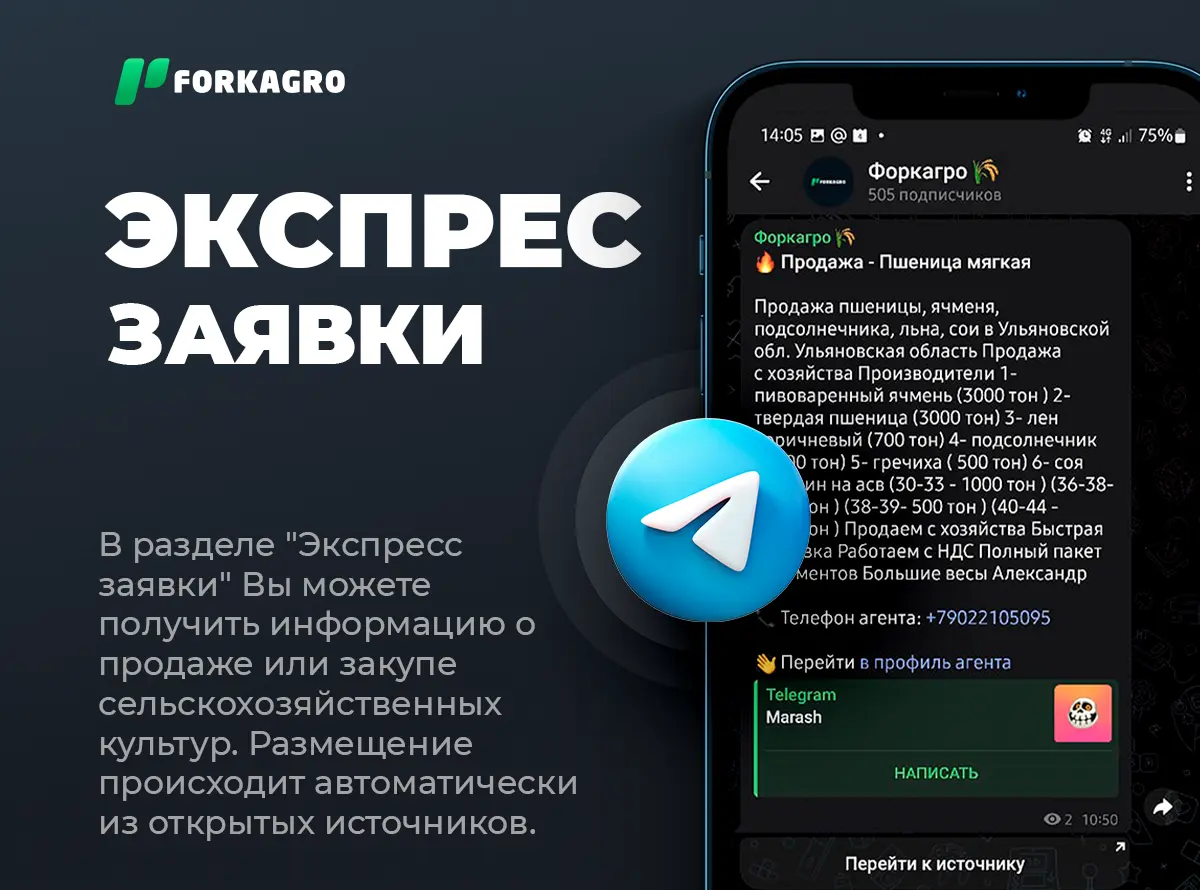

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory