In response to requests from farm enterprises for the possibility of delaying loan payments for a year in case of emergencies, Rosselkhozbank (RSHB) is planning to appeal to the Russian authorities to consider this issue. The statement was made by the bank's deputy director Denis Konstantinov during a meeting of the Association of Peasant (Farm) Enterprises and Agricultural Cooperatives of Russia (AKKOR).

During the association meeting, which took place within the framework of the XI Open Plowing Championship of Russia, the head of AKKOR in the Rostov Region, Alexander Rodin, proposed that the bank implement a one-year grace period for repayments of preferential loans for farms affected by natural disasters in the current year. Currently, small enterprises are allowed to use semi-annual credit holidays once every five years without damaging their credit history. However, Alexander Rodin noted that such a delay will not solve the problem for farms engaged in crop production due to the duration of the seasonal production cycle in agriculture exceeding half a year.

Denis Konstantinov noted that the bank strives to meet the needs of its clients to the maximum extent by individually solving the problems of borrowers affected by emergencies. The bank is interested in its clients continuing to use its services for as long as possible, but preferential loans have conditions, the violation of which turns them into commercial loans with higher interest rates.

"Your resilience is of great importance to us: if we hinder your work, we will cause problems - first economic, then financial, and in the end, you will not be able to repay the money. We actively advocate for sensible and prolonged restructuring," commented Denis Konstantinov.

He also added: "We will definitely request the Ministry of Agriculture, request at all levels, so that in case of emergencies, it will be possible to add even more time for restructuring - a year, and possibly more."

The sown areas of agricultural crops in all farms in Russia decreased by 1.19% in 2024 compared to 2023 (to 80.185 million hectares), including areas under cereals and leguminous crops at 46.127 million hectares (a decrease of 3.97%). According to the Deputy Minister of Agriculture of the Russian Federation, Andrey Razin, the area of crops affected by recurrent frosts at the end of May exceeded 1.1 million hectares, most of which were successfully replanted.

In turn, the deputy director of RSHB noted that the bank is currently exploring the possibilities of providing all permitted loan deferments for farmers affected by actions in the Kursk region.

"We are compiling lists of affected farmers and agricultural producers operating in the Kursk region. Currently, we are negotiating with the Ministry of Agriculture about what opportunities we can provide to the affected in terms of preferential financing. The authorities will do everything possible to help, and we also have such a decision," he said.

In early August, it became known that after the Central Bank of Russia raised its key rate in mid-July, the Ministry of Agriculture temporarily stopped issuing preferential loans to farmers from July 29. Currently, the mechanism for providing preferential lending to agricultural producers depends on the refinancing level. There has been no response from the Ministry of Agriculture regarding the resumption of the program.

Denis Konstantinov noted that it is currently difficult to say what changes will occur. He emphasized that there is currently an adjustment being made by the Ministry of Agriculture, and he cannot make any announcements. However, he is confident that the conditions for providing preferential loans will be flexible and maximally favorable for farmers.

Preferential lending for strategic sectors of the agro-industrial complex before the Central Bank rate hike allowed loans to be provided at an interest rate of about 6.8% per annum, for sectors not included in the first priority - about 10%. Due to the rate hike, interest rates have increased to 11%. However, it is expected that this level of interest rate will be regulated.

"We hope that the changes being developed by the Ministry of Agriculture will make the favorable conditions for granting loans as possible. It is important to note that we are the only lending bank in seven regions providing 70% of financial support for seasonal field work," said Denis Konstantinov.

For the first seven months of this year, RSHB invested 1.2 trillion rubles in agriculture, which is 32.4% higher than the same period last year. Support for small forms of farming amounts to 84 billion rubles (an increase of 41.8%). Preferential lending within the overall support for the agro-industrial complex has increased by 37.4%, to 411.2 billion rubles. The bank is the lender for seasonal field work in 70% of the country's regions, and in some of them, it is the only bank.

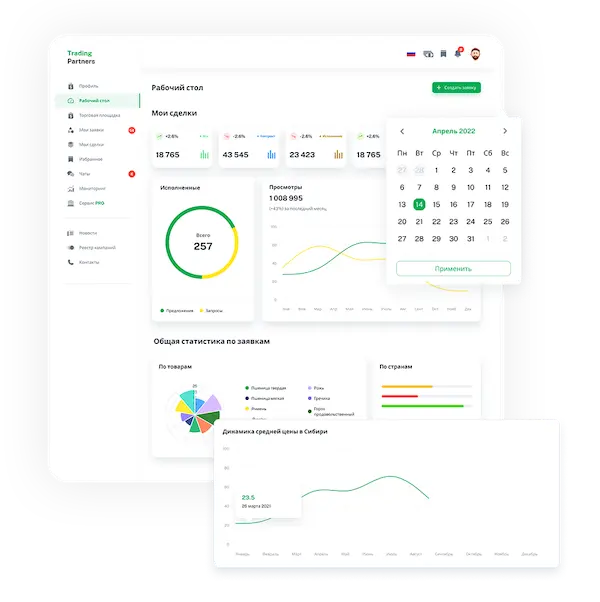

Trading platform

Trading platform

Monitoring

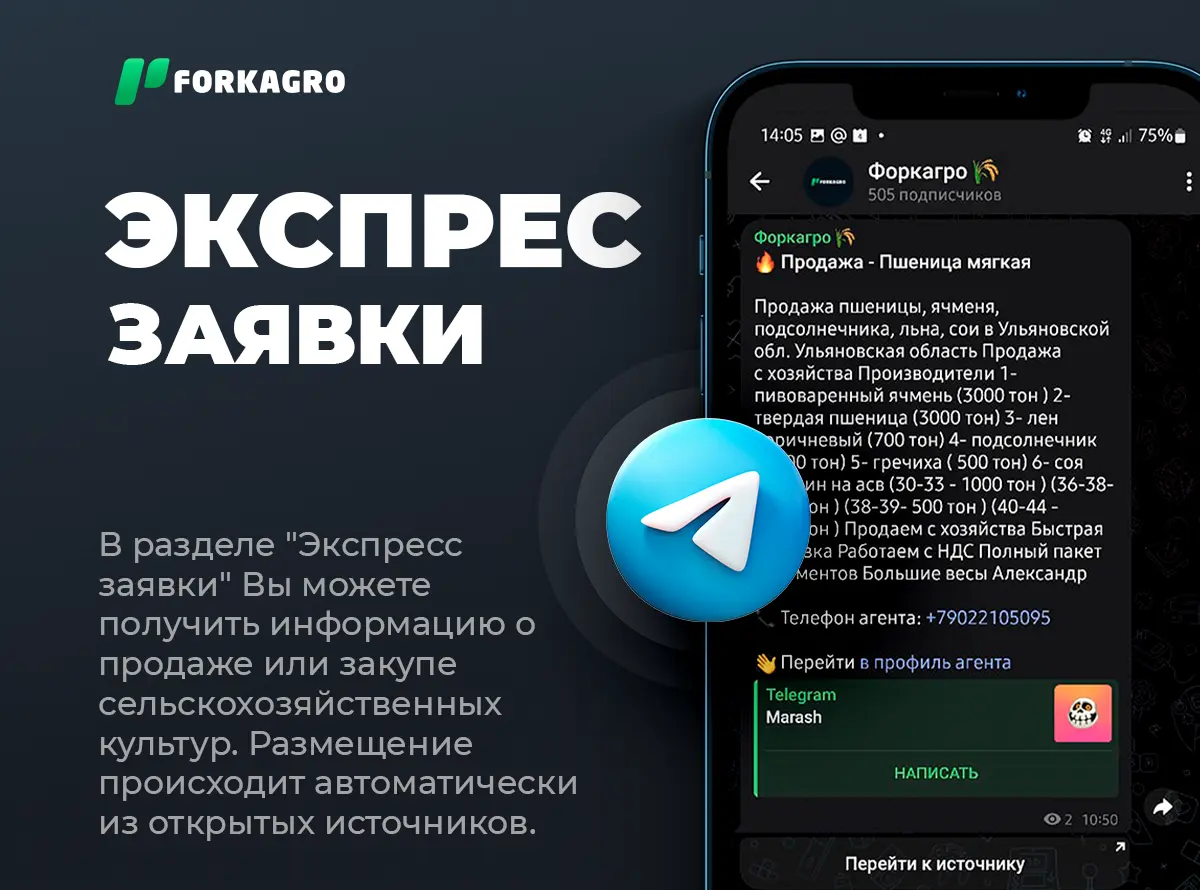

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory