The views of Indian officials on wheat stock trading are currently the subject of public discussion. However, the current Indian administration has issued an official document permitting the state-owned company FCI to start selling wheat from their stocks to wholesale consumers. This decision was made after considering various factors.

The purpose of this initiative is to provide an advantage to flour mills and wheat product manufacturers, allowing them to purchase wheat at significantly lower prices. The price offered by FCI is $279 per tonne or 23,250 rupees, which is approximately 12% below the market price. This offer will make wheat grain procurement attractive to entrepreneurs.

However, despite the attractive terms, the exact quantity of wheat to be offered in the domestic market is currently unknown. FCI has not specified the exact amount of grain they plan to sell. However, it is expected that this offer will generate significant demand among entrepreneurs interested in buying wheat grain in large quantities.

Existing data already show a large volume of wheat sales to private players in 2023. Starting from June, over 10 million tonnes of grain have been sold, marking a record figure in recent times.

The statistics of state wheat stocks indicate 29.9 million tonnes of grain as of June 1. This number represents a slight decrease compared to the previous year when stocks were at 31.4 million tonnes.

In order to address potential consequences in the wheat market, the Indian government has decided to impose restrictions on the wheat stocks that traders can hold. Additionally, there is consideration to either cancel or reduce taxes on grain imports to regulate domestic prices and balance the market.

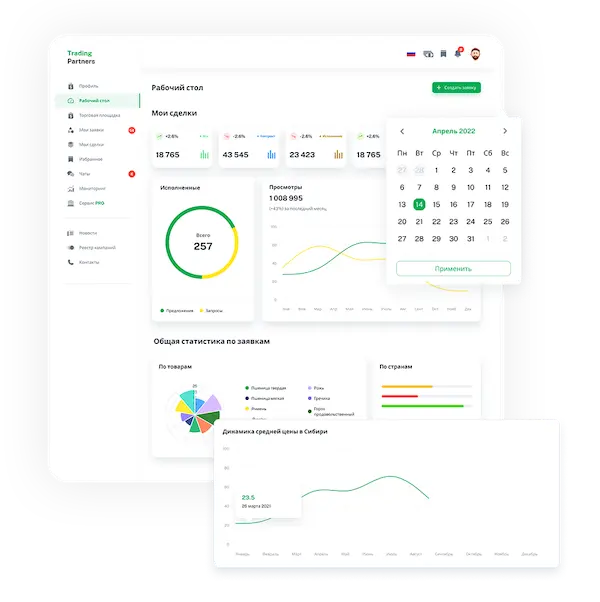

Trading platform

Trading platform

Monitoring

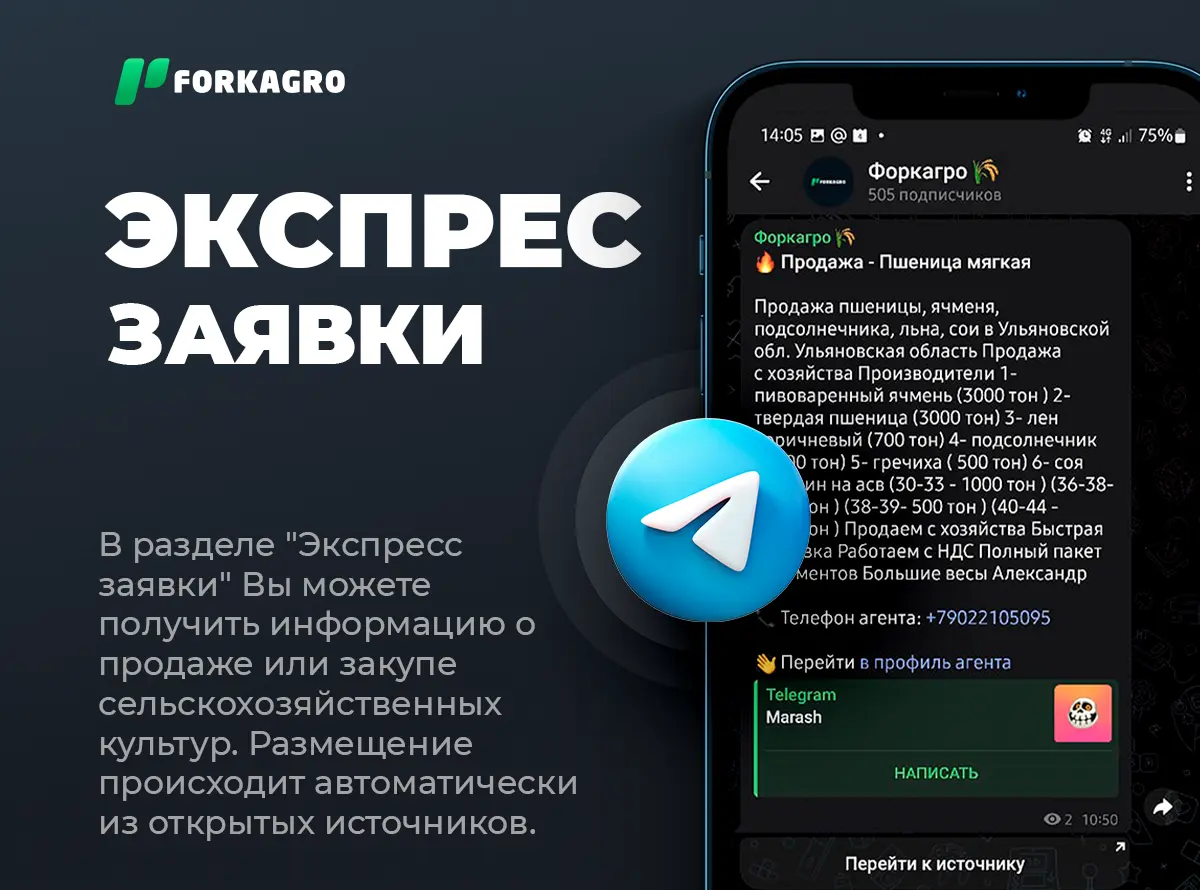

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory