At best, this year's grain harvest is expected to reach the level of 2024, amounting to about 125 million tons, in the absence of risks. However, the most likely scenario is a decrease in yield, said Arkadiy Zlochevsky, the president of the Russian Grain Union (RGU), during a press conference. He noted that all current forecasts are assumptions, but it can be stated unequivocally that the harvest will be lower than that of 2024 due to the presence of risks that will inevitably manifest. One of the main factors affecting the decrease in yield is insufficient technological advancement in production.

According to Zlochevsky, a large part of winter crops is in poor condition (37%), but this is not a death sentence. With the melting of snow and the resumption of vegetation, moisture reserves have been replenished, providing plants with sustenance. However, vegetation is not yet active due to insufficiently high positive temperatures. Plants are still dormant, but they are strengthening, improving their survivability in current conditions. However, severe frosts below minus 20 degrees can pose a danger, although meteorologists are not predicting their occurrence at the moment, Zlochevsky explained.

With the snow melting, other risks arise. For example, in some areas of the Volga region, an icy crust forms on the fields. Zlochevsky warned that under certain conditions, the icy crust can damage plant stems and lead to their demise. There is also a risk of sowing crops under the icy crust, which can negatively impact the yield. However, the most critical issue is the presence of moisture reserves in the spring. Zlochevsky believes this is a serious threat to the plants.

Furthermore, the head of the RGU reported that the union has lowered the grain export forecast for the 2024/25 season from 52 million tons to 47-48 million tons, including 41-42 million tons of wheat. Grain exports in January fell by two-thirds compared to last year, which, according to Zlochevsky, is due to the rise in domestic prices amid sufficiently low global prices. He also explained that in the past, exporters reduced procurement activity when domestic and external grain prices did not match, leading to a decrease in domestic prices, but this was possible due to high grain stocks. Currently, grain reserves are small, and prices are not decreasing, so exporters have significantly reduced their activity.

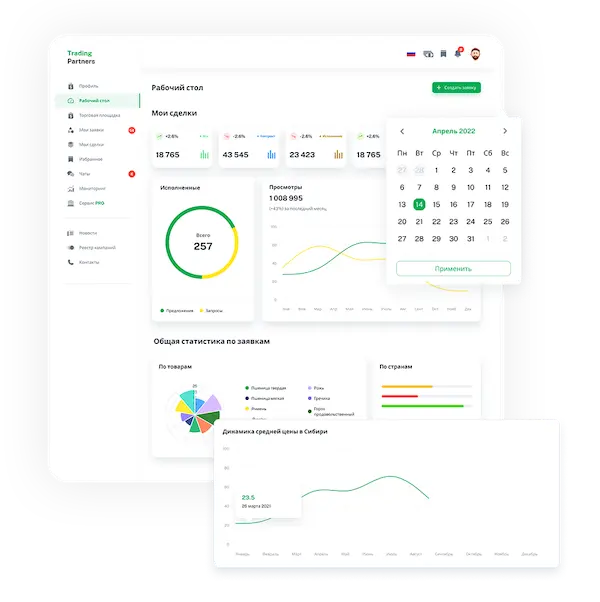

Trading platform

Trading platform

Monitoring

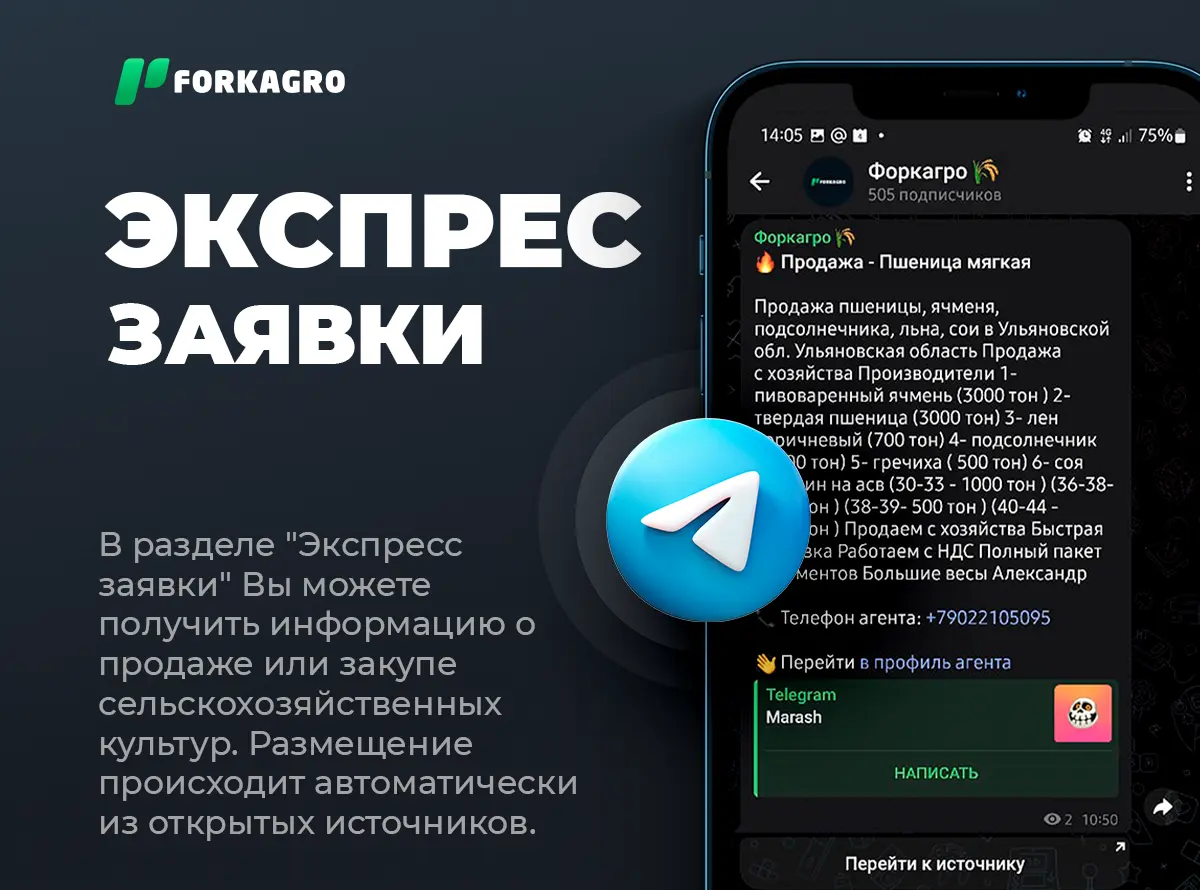

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory