Increased demand for cotton in China reflects growing need in recent years

In recent years, China has increased its cotton imports, reaching a record of 650,000 tons in 2022/23. It is forecasted that cotton imports will remain at a high level in 2023/24 and 2024/25, though below the record level. China buys almost all imported cotton from Australia and the United States, while Pakistan, Cameroon, Benin, and Myanmar export small amounts of cotton.

Over the past 5 years, China has significantly increased cotton imports from Australia - from zero levels to over 650,000 tons in 2022/23. Crop recovery after a two-year drought allowed Australia to return to pre-existing levels of cotton exports. In 2021/22, excellent weather conditions significantly boosted cotton exports from Australia, a trend continuing into 2022/23 and 2023/24. It is anticipated that cotton production in Australia in 2024/25 will remain high, reaching almost 1.3 million tons. China also expanded market access to the United States in 2021, with shipment volumes reaching a record level of almost 110,000 tons with a one-month delay in 2023/24.

Data Revision

Various data has been revised during the period from 2016/17 to 2024/25, including soybean meal production in South Korea and palm oil production in Indonesia. The changes made are related to the preference for high-protein soybean meal and shifts in food consumption patterns. These revisions have impacted stocks and exports of both products.

2024/25 Forecast

The forecast for global oilseed production has been slightly reduced to 687.3 million tons due to decreased volumes of soybeans in the U.S. and Ukraine. This decrease has not been offset by the increased production of sunflower seeds in Argentina and cotton in China. Global trade of oilseeds has also slightly decreased due to reduced canola exports from Canada. It is projected that final oilseed stocks will decrease by over 200,000 tons due to lower rapeseed volumes in Canada and the EU.

Global oilseed processing will increase by almost 400,000 tons to nearly 557.7 million tons, primarily driven by increased rapeseed utilization in China and the EU. This is slightly offset by reduced soybean processing in Thailand. World trade in meal has slightly increased due to expanded sunflower meal trade. However, global trade in vegetable oil will decrease by over 700,000 tons due to reduced palm oil trade volume in Indonesia, not compensated by increased palm oil exports from Thailand.

The average seasonal price for soybeans in the U.S. will remain unchanged at $10.80 per bushel.

Export Prices

Soybean prices rose after adverse weather conditions in South America affected planting season. However, they slightly declined after rains arrived in various regions of Brazil. Soybean meal prices mostly followed soybean prices. U.S. soybean oil prices rose for the majority of September along with other vegetable oil prices, driven by expectations of reduced palm, canola, and sunflower oil supplies. Palm oil prices decreased due to reports of production cutbacks and low stocks in Indonesia. Sunflower and rapeseed oil prices increased due to expectations of low export deliveries following yield reductions in Europe and the Black Sea region.

Balances

References to balances are provided for more detailed information on various positions, such as sunflower oil imports, oilseed reserves in Russia, sunflower oil exports from Russia, sunflower meal imports, rapeseed oil imports, and others.

The full review text is available in the attached files.

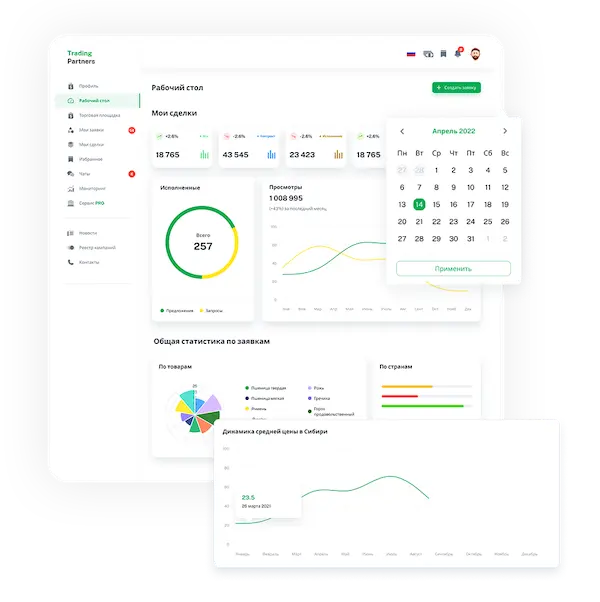

Trading platform

Trading platform

Monitoring

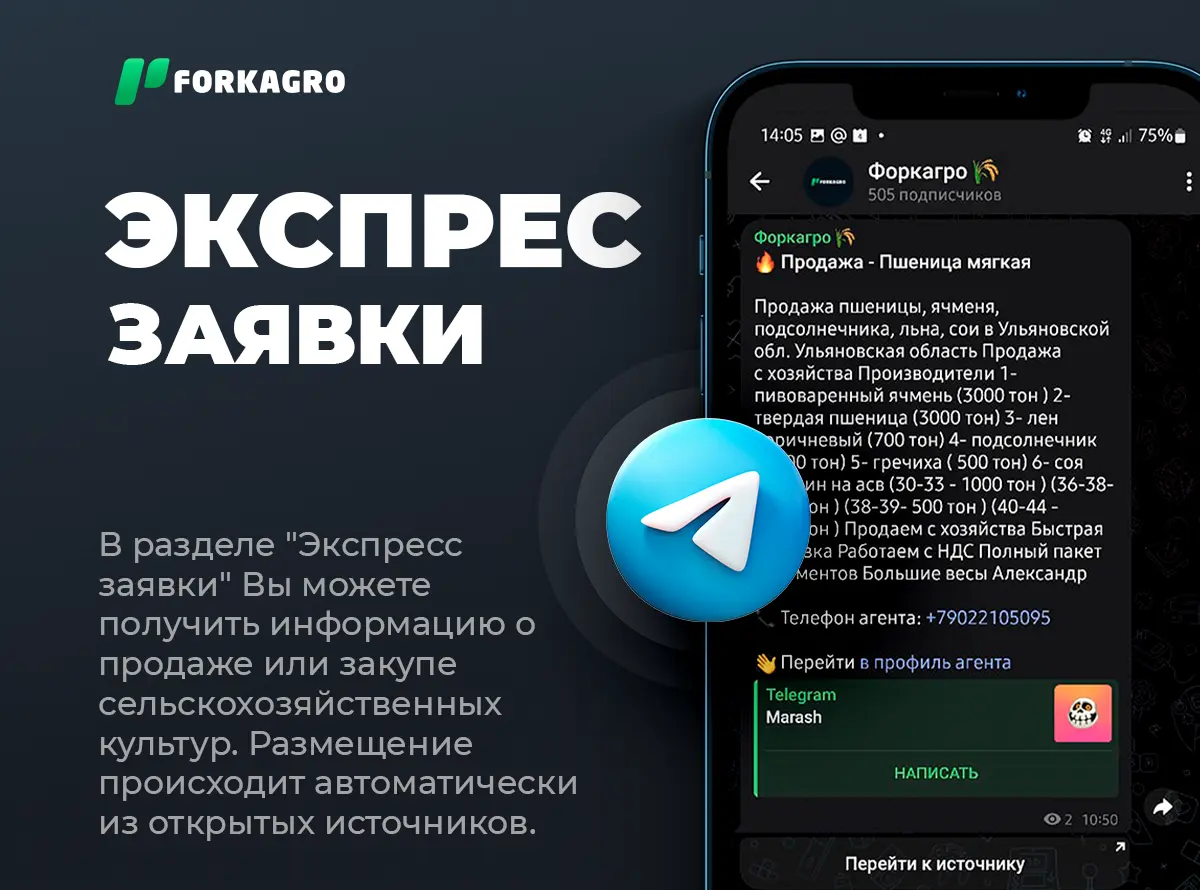

Monitoring  Express applications

Express applications

Fork Work

Fork Work

Service

Service  News

News  Directory

Directory